Branch Transformation and Self-Service: The Future of Banking

One thing is clear: the future of banking lies in transformation. As technology continues to revolutionize the way we manage our finances, traditional brick-and-mortar branches need to adapt to meet the changing needs of customers. But what are the needs of a typical bank customer?

The Shift to Digital Banking

It’s no secret that the pandemic brought on thousands of branch closures – over 3000 just in 2020 – and with that, customers have shifted towards doing most of their banking online. According to Forbes, 78% of adults in the U.S. prefer to bank via a mobile app or website, with only 29% of Americans preferring to bank in person.

The Vanishing Bank Teller

We can’t blame the pandemic for in-person banking becoming an inconvenience for customers. Online banking platforms have existed for years, but the pandemic escalated things, specifically the number of bank tellers. The number of teller jobs is greatly decreasing, projected to fall by 15% by 2032 – that’s about 53,000 positions.

Tellers may be going away, but the physical bank branch cannot. A branch is where customers get expert guidance on complex financial situations that they can’t navigate themselves just through online banking. Customers are more likely to seek face-to-face service for large transactions, loan applications, or other major banking needs.

So, banks should aim to better engage customers and transform a branch into a hub of financial optimization. But how?

The Path to Branch Transformation

By incorporating more efficient systems like mobile apps, self-service kiosks and optimized websites, banks can deliver an enhanced customer experience.

You might ask – isn’t an ATM a self-service kiosk that allows customers to serve themselves? Yes, but more can be done with the self-service style of an ATM than just withdraw and deposit cash.

Branch in a Box: Self Service Machines

Self-service machines need to become more advanced - giving customers the power to carry out routine transactions like printing check sheets, cashier’s checks, and other financial documents like bank statements quickly and efficiently, without the need for human intervention. This not only reduces wait times for customers, but also allows bank staff to focus on more complex inquiries, thereby improving overall service quality.

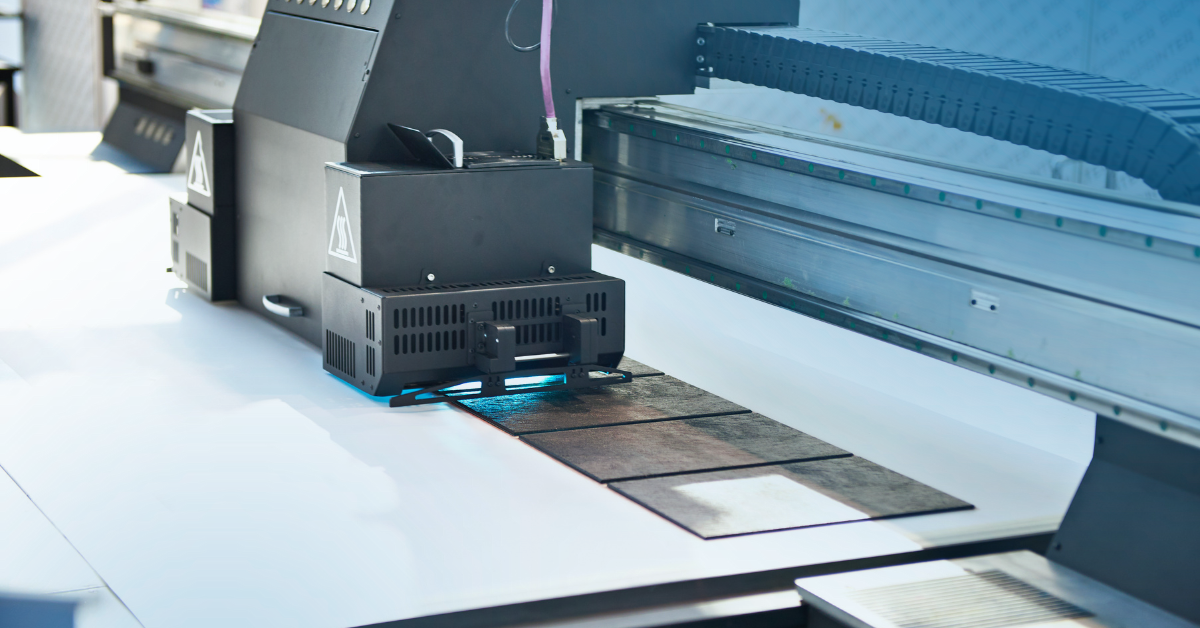

TROY TellerCentral

The answer is here. Introducing the TellerCentral a revolutionary self-service machine designed for banks to increase their engagement by giving customers the option to print their secure checks and documents without having to rely on banking professionals or tellers. Incorporating the TellerCentral into branches will:

Streamline Operations: Reduce wait times, minimize teller workload, and optimize efficiency, freeing up staff to focus on personalized service and higher-value tasks.

Drive Revenue: Unleash new revenue streams by offering check printing as an additional service. Whether it's personal or business checks, TellerCentral will cater to a wide range of customer needs, enhancing loyalty and driving profitability.

Future-Ready: Stay ahead of the curve with our future-ready solution. As banking continues to evolve, our self-service machines adapt to meet the changing needs of your customers, ensuring you remain at the forefront of innovation.

The Importance of Security

In an age where threats loom large, ensuring the security of banking transactions is paramount. Self-service kiosks equipped with advanced security features, such as the TellerCentral, provide customers with peace of mind knowing their sensitive information is protected.

Each TellerCentral unit prints checks with TROY’s patented MICR Toner Secure, the World’s Most Fraud Resistant Toner. This specialized MICR toner meets the American Banking Association requirements for checks, with an added layer of security. If chemical alteration is attempted on a check, MICR Toner Secure will bleed red, immediately alerting the banks of fraud.

The Future of Banking is Here

As we look ahead, the future of banking branches is undoubtedly intertwined with the adoption of more self-service options. These innovative solutions will continue to evolve, offering an ever-expanding array of services to meet the evolving needs of customers. From mobile check deposits to biometric authentication, the possibilities are endless.

Branch transformation is well underway, and it’s important to pay attention. These innovative solutions are reshaping the way customers interact with their banks, offering unprecedented convenience, security, and efficiency. As we embrace the future of banking, self-service machines like the TellerCentral will undoubtedly play a central role in delivering superior customer experiences and driving continued innovation in the industry.

Visit our page to find out more about the TellerCentral.

Related Posts

What is UV Printing? UV Curable Inks for Packaging

Ultraviolet, or UV printing is an advanced digital technology that cures specially designed inks using UV light. This process creates sleek, vibrant designs that dry instantly,..

Here's How to Beat Upcoming Postage Rate Increases

In 2024, a notable increase in postage costs became a reality. With postage increases expected to occur multiple times a year, it's important to be prepared for what's coming.

What is MICR Toner? A Guide for Check Printing

What is MICR? MICR stands for Magentic Ink Character Recognition, and it plays a critical role in check printing. If you're printing checks for your business, you should always be..

Leave a Reply