Here's Why Millennials Are Still Using Checks

In a recent study done by Qualtrics on millennials, one statistic jumps out as surprising. When it comes to consumer transactions, payment apps like Zelle or CashApp are popular, but the trusted paper check is still holding its own.

42% of millennials are still regularly writing checks, which is more than most own video game consoles. This means that almost 3 times more millennials use checks than mobile payment platforms. Not just that, but millennials are 5 times as likely are more likely to use cash than mobile payment platforms or even debit cards.

What is causing this trend? It may not be as surprising as you might think.

Millennials: The Self-Employed Generation

Check usage among millennials can be attributed to unique socioeconomic circumstances. Particularly, their move towards self-employment and the gig economy. Unlike previous generations, millennials have been increasingly drawn to freelance work, entrepreneurship, and side hustles.

In 2016, it was predicted that 10.5 million individuals in the United States would have become self-employed by 2030, but that escalated faster than anyone thought.

The end of 2019 saw 30% of Americans working as freelancers. In 2022, 4 million new businesses were established in the US, which was yet another 30% increase from 2019.

Check Usage in the Small Business World

You might wonder, what does self-employment have to do with the resurgence of checks? Well, self-employed individuals often rely on invoicing clients or customers directly, and what’s the most common form of B2B transaction? Checks.

Checks make up 51% of B2B payments, with 81% of businesses saying they still use checks from time to time, even if it is not their preferred method. When it comes to small businesses, vendors may prefer to be paid by check, and these millennial business owners need to be prepared to issue one to get their materials.

Why Not Digital Payments?

Unlike digital payment platforms that may impose transaction fees, checks enable individuals to retain full control over their earnings without being subjected to third-party intermediaries. This is particularly valuable for freelancers and small business owners who want to hang onto as much of their money as possible without losing to any useless fees.

Fraud is also a major risk for digital payments. The popularity of payment apps like CashApp or Zelle have made them a goldmine, the latter garnering $490 Billion in transfers just in 2023. ACH fraud has grown 6% since 2021, and with fraudsters becoming more tech-savvy, the risk and losses are only going to increase.

Digital payment scams are riskier than just having one transaction stolen. Zelle relies on users to connect their bank accounts and debit cards directly to the platform, which means if even only one transfer is hacked, fraudsters can go much further.

Dangers like this could be detrimental to a small business.

The Security of Checks

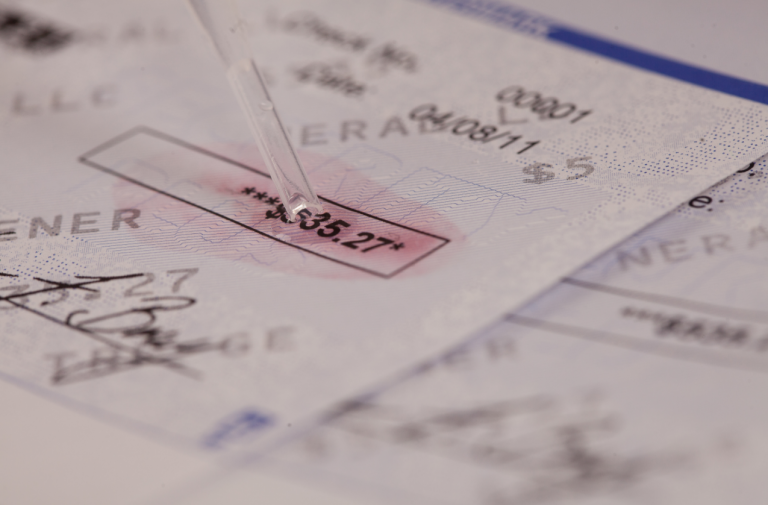

While checks still remain a relied upon method, they themselves have their shortcomings when it comes to security. Check fraud is rising, with 680,000 reported cases in 2022. In 2024, check fraud is expected to hit $24 Billion in losses. At the crux of the issue is older fraud techniques like mail theft and check washing becoming more prevalent, with $815 Million being attributed to check washing schemes in 2023.

However, the difference between check fraud and ACH fraud is huge. When it comes to checks, not only is the fraud localized to one payment, but you can actively protect your checks with TROY Solutions.

Check washing occurs because the MICR (Magnetic Ink Character Recognition) ink or toner that the check is required to be printed with can be easily washed or scraped. Standard MICR toner provides zero protection against check washing, but TROY MICR Toner Secure does.

Not only is TROY MICR Toner Secure a high-adhesion toner that meets banking requirements, but it is engineered to prevent fraud. MICR Toner Secure contains TROY’s patented red dye that bleeds red whenever any chemical alteration has been attempted. This alerts the bank of fraud and the fraudster that they’ve been caught.

TROY’s Secure Check Printing Solutions

Paired with our other secure check printing solutions, small business owners can start printing checks in-house while keeping all their customer data and payment information in one place.

TROY FlexPay: TROY FlexPay is our secure, cloud-based payment software for small businesses. It integrates with a user’s QuickBooks client data and gives them the flexibility to pay vendors either by ACH, digital check, check fulfillment service, or print their own check in-house all from one platform.

TROY MICR Toner Secure: As we mentioned, TROY MICR Toner Secure is the only MICR toner that can actively protect checks from washing through our patented red dye that bleeds red whenever check washing is attempted. No other MICR toner in the world can do this.

Secure TROY HP MICR Printers: Through our OEM partnership with HP, TROY is authorized to take a standard HP printer and enhance it with the capability to securely print MICR on checks. These MICR printers come with advanced security features such as exact positioning technology so your MICR lines are printed correctly, unique user verifications, toner sensing, and more.

As the millennial self-employed generation continues to forge new paths and embrace alternative modes of employment, checks will undoubtedly remain a hammer in their financial toolkit. With TROY’s customizable end-to-end solution to print and send secure check payments, SMB’s will never have to worry about fraud.

Related Posts

What is UV Printing? UV Curable Inks for Packaging

Ultraviolet, or UV printing is an advanced digital technology that cures specially designed inks using UV light. This process creates sleek, vibrant designs that dry instantly,..

Here's How to Beat Upcoming Postage Rate Increases

In 2024, a notable increase in postage costs became a reality. With postage increases expected to occur multiple times a year, it's important to be prepared for what's coming.

What is MICR Toner? A Guide for Check Printing

What is MICR? MICR stands for Magentic Ink Character Recognition, and it plays a critical role in check printing. If you're printing checks for your business, you should always be..

Leave a Reply