ACH Fraud is Rising: Understand the Risk

It’s no secret that payments between consumers and businesses are increasingly moving towards digital. While consumers rely on debit/credit cards or “on the go” electronic payment services like CashApp, Venmo, or Zelle just to name a few, businesses rely heavily on both electronic transactions and checks for their financial operations.

While electronic payments offer convenience and efficiency, they also bring about new risks, one of the most prominent being ACH (Automated Clearing House) fraud. As businesses embrace the digital economy, it's crucial to understand the prevalence of ACH fraud, its impact, and why traditional checks still hold an edge.

What is ACH?

ACH stands for Automated Clearing House, and is a network used for electronically moving money between bank accounts. ACH works generally the same as wire transfer, except ACH may take a few days for the payment to clear.

ACH is one of the most common and popular types of B2B transaction. In 2020, ACH payments saw an 8.2% rise in transaction volume, with a 10.8% increase in value. However, ACH still falls behind check transactions, which still account for around 80% of B2B transactions.

Because ACH is faster, it's rising as a form of payment between businesses and vendors. However, the increase in ACH payments also brings about an increase in digital payment fraud. According to Plaid, ACH fraud increased by 6% between 2021 and 2023. In a way, ACH fraud works similarly to check fraud but is more easily executed. Criminals only need two pieces of information to commit ACH fraud – the bank account and routing number, and nothing physical.

Understanding ACH Fraud

ACH fraud involves unauthorized transactions initiated through the ACH network, which electronically processes large volumes of credit and debit transactions. Fraudsters exploit vulnerabilities in the system, often gaining access to the sensitive details they need to carry out their scheme - bank account numbers and routing details. Once obtained, they can initiate fraudulent transactions, siphoning funds from business accounts without detection.

The scale of ACH fraud is staggering. According to BusinessWire, payments fraud spiked 71% of businesses saw an increase in fraud attempts in 2023, with the average loss of over $1M. These losses not only impact the financial health of businesses but also erode trust and confidence in electronic payment systems.

The Electronic Nature of ACH and Its Vulnerabilities

The electronic nature of ACH transactions contributes significantly to the prevalence of fraud. Unlike traditional paper checks, which require physical signatures and multiple layers of verification, ACH transactions are conducted entirely online, making them susceptible to cyberattacks and data breaches. Additionally, the speed and anonymity of electronic transactions provide fraudsters with ample opportunities to exploit weaknesses in the system.

The complexity of the ACH network, involving multiple parties such as banks, processors, and third-party service providers, creates additional points of vulnerability. Fraudsters exploit these complexities to obfuscate their activities and evade detection, making it challenging for businesses to mitigate risks effectively.

Common ways ACH fraud can occur

- Fraudulent ACH returns: ACH fraud exploits return mechanisms, including bank-initiated and customer-initiated returns, where fraudsters exploit insufficient funds for profit or claim unauthorized transactions to retrieve funds, highlighting vulnerabilities in the system.

- Phishing Attacks: Phishing attacks involve sending deceptive emails or texts to trick individuals or organizations into divulging sensitive banking information, which is then exploited to initiate unauthorized ACH payments. You may know about phishing attacks from IT training, but they can be much more dangerous when real fraudsters are targeting your organization.

- Ghost Funding: Ghost funding fraud involves users being immediately granted access to funds not yet fully settled through ACH, exploited by fraudsters for profit

Why Companies Are Still Using Checks

Despite the rise of electronic payments, traditional checks remain a secure and reliable means of conducting business transactions and are still the most common form of payment between companies. But why?

Firstly, checks are the most familiar form of payment because of their longstanding usage and processes that are already in place for businesses and banks to accept them. Many companies’ traditional AR and AP departments are designed to accommodate check transactions, making it difficult to shift towards a fully ACH realm. But what are some other reasons besides just familiarity?

- Physical Verification: Unlike electronic transactions, which occur virtually, checks involve physical documents that require signatures and manual verification. This physicality adds an extra layer of security, reducing the likelihood of unauthorized transactions.

- Limited Exposure to Cyber Threats: Since checks are not transmitted electronically, they are less susceptible to cyberattacks and data breaches. This inherent limitation reduces the risk of unauthorized access to sensitive financial information.

- Transaction Reversibility: In the event of fraudulent activity, checks offer greater recourse for businesses to dispute transactions and recover lost funds. The process of stopping payment or issuing a new check provides businesses with greater control over their finances and mitigates the impact of fraud.

- Localized vs. Global Risk: With electronic payments, you open your account information to anyone in the world who can hack into your payment platform, which includes fraudsters from other countries. Fraud attempts on checks are more manageable, often localized to one mailbox.

What about Check Fraud?

Yes, check fraud is a problem, even in 2024. Many news outlets have been reporting to “stop using checks" because of its historic rise since the pandemic. FinCen reported there were over 680,000 reported cases of check fraud in 2022 alone, and losses are expected to hit 24B in in 2024.

FinCen even put businesses and banks on high alert when they sent out a warning just this past February in conjunction with the USPS warning of the increased mail theft. Checks are being stolen out of mailboxes at a rapid rate and are being tampered with by way of check washing schemes, where the fraudster alters payee and amount information to go directly into their own bank accounts.

TROY’s Solution to Fraud: The World’s Most Fraud Resistant MICR Toner

While FinCen gave tips on how to avoid check fraud in their alert, they didn’t provide a concrete solution. The way to stop fraud isn’t through jumping through a list of hoops to avoid fraudsters from stealing your checks. The solution is through in-house check printing with TROY’s patented MICR Toner Secure™.

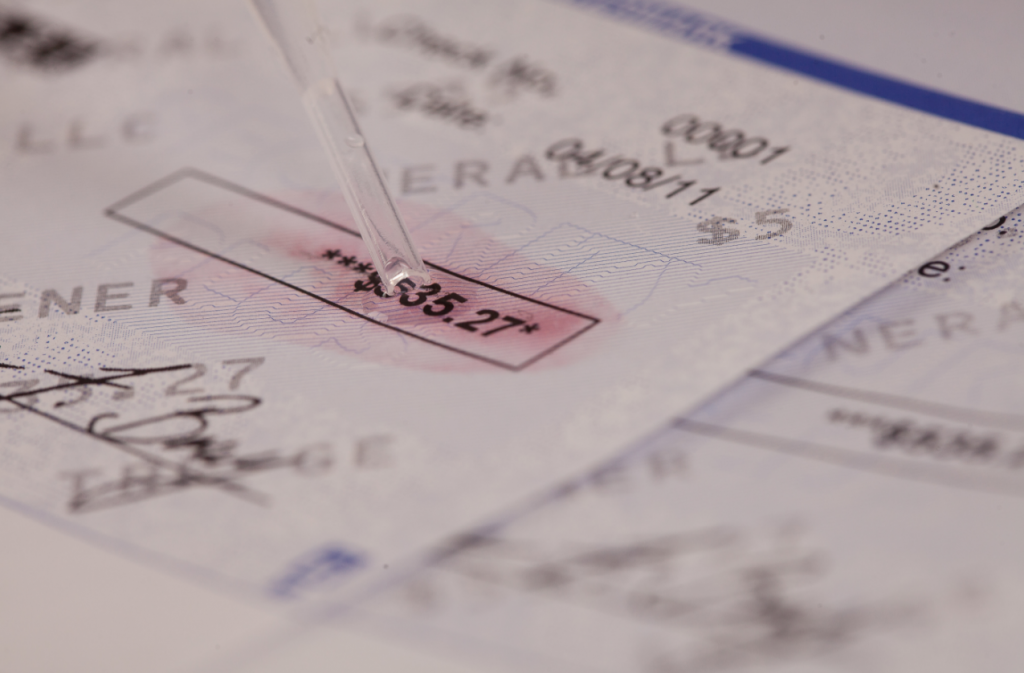

MICR Toner Secure™ is TROY’s patented solution to check fraud. with MICR Toner Secure™, your checks are protected with our patented red dye embedded in the MICR toner. This means any time chemical alteration is protected on a check, the characters will bleed red, signaling to the bank that fraud has been committed, and to the fraudsters that their jig is up.

MICR Toner Secure ™ is the only MICR toner on earth that has this capability. It also is a high adhesion toner, which means it’s not easily scraped, and has high readability for image and MICR quality. With MICR Toner Secure, you’ll not only keep your checks secure, but you’ll meet the American Banking Standards every time you send a check. and is why it’s the trusted solution by banks and businesses all around the world.

Paired with a TROY HP secure MICR printer and blank check stock from TROY, you’ll have the capability and the safety to start printing checks from your office, without ever having to worry about fraud.

Choose TROY's End-to-End Solution for Fraud

While electronic payments offer convenience and speed, they also expose businesses to significant risks. Understanding the prevalence of ACH fraud and its underlying vulnerabilities is crucial for businesses to implement effective risk management strategies.

Although check fraud is prevalent in 2024, checks are still a safer and more trusted option, and checks printed with TROY’s MICR Toner Secure™ have enhanced security and reliability. By leveraging TROY’s secure technology, businesses can safeguard their financial assets and mitigate the risks associated with electronic payments.

Shop on our store to purchase MICR Toner Secure now

Related Posts

What is UV Printing? UV Curable Inks for Packaging

Ultraviolet, or UV printing is an advanced digital technology that cures specially designed inks using UV light. This process creates sleek, vibrant designs that dry instantly,..

Here's How to Beat Upcoming Postage Rate Increases

In 2024, a notable increase in postage costs became a reality. With postage increases expected to occur multiple times a year, it's important to be prepared for what's coming.

What is MICR Toner? A Guide for Check Printing

What is MICR? MICR stands for Magentic Ink Character Recognition, and it plays a critical role in check printing. If you're printing checks for your business, you should always be..

Leave a Reply