The 4th Generation of Core Banking: A Platform Revolution

The 4th generation of core banking has arrived, bringing with it a platform revolution that is reshaping the banking industry. This transformation heralds the transition from legacy systems to next-generation platforms, catalyzing the sector's embracement of innovation and driving the strategic adoption of solutions like TellerCentral.

Schedule a call with TROY today

Embracing the 4th Generation of Core Banking

In today's fast-evolving financial landscape, the need for more agile, scalable, and customer-centric banking solutions has never been greater. The advent of Core Banking 4.0 marks a significant leap forward, leveraging advanced technologies to redefine how banks operate and engage with customers. This new era, known as the platform revolution, is characterized by a shift from traditional siloed systems to comprehensive, integrated platforms that empower financial institutions to future-proof their operations and enhance customer experiences.

The 4th Generation of Core Banking: Platform Revolution

The 4th generation of core banking platforms stands as a testament to the industry's commitment to innovation and excellence. This phase is not just about upgrading technology; it represents a fundamental change in how banks approach their core operations and service delivery. Below are the defining features and benefits of this transformative wave:

Talk to us

The Transition from Legacy Systems to 4th Generation Core Banking Platforms

The transition to Core Banking 4.0 is a pivotal moment for the banking sector. Moving away from outdated, rigid legacy systems, banks are now embracing modern platform-based infrastructures. This shift is driving the banking sector's strategic adoption of TellerCentral, enhancing security, efficiency, and customer satisfaction.

Talk to us

What is Core Banking 4.0?

Core Banking 4.0 is an advanced technological framework that enables banks to deliver superior financial services through innovation and integration. It offers a holistic approach, combining cutting-edge technologies to create seamless, scalable, and adaptive banking platforms.

Breaking Legacy Barriers: Overcomes Silos and Rigidity of Traditional Platforms

One of the most significant advantages of the 4th generation platforms is their ability to overcome the limitations of siloed and rigid legacy systems. This fosters a more collaborative and dynamic banking environment.

Enhanced Flexibility: Adapts to Dynamic Customer Needs and Behaviors

Banks can now offer personalized, flexible services that cater to the evolving needs and behaviors of their customers. This enhanced flexibility drives customer loyalty and satisfaction.

Cost Efficiency: Reduces Maintenance Costs and Speeds up Go-to-Market (GTM)

By reducing the complexity and cost of maintaining legacy systems, Core Banking 4.0 enables banks to allocate resources more efficiently. It also speeds up the go-to-market process for new products and services, ensuring a competitive edge.

APIs & Advanced Tech: Utilizes Machine Learning for Improved Security and Interoperability

The integration of APIs and advanced technologies like machine learning enhances security and interoperability. This allows for more robust, intelligent banking systems that are better equipped to handle emerging threats and opportunities.

Future-Ready: Ensures the Bank's Readiness for Upcoming Digital Trends and Demands

Core Banking 4.0 platforms are built to be future-ready, ensuring that banks are well-prepared for upcoming digital trends and market demands. This future-proofing capability ensures long-term sustainability and growth.

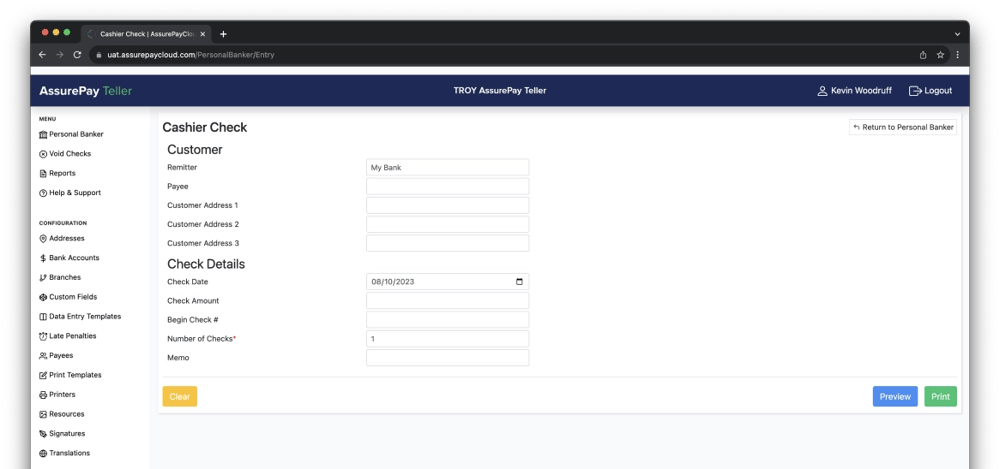

Revolutionizing Banking with TellerCentral

As the banking industry continues to evolve, staying ahead of the curve is crucial. Investing in smart ATM technology and embracing digital transformation strategies will not only meet current consumer demands but also pave the way for future innovations. Join the movement and redefine the customer experience in the digital age.

Contact our experts