Innovative Check Printing Software Increases Efficiency & Security

With two versions of AssurePay to choose, banks, credit unions and corporations can add layered security to printed checks without adding additional work to personnel.

Check Fraud is Real

With 71 percent¹ of U.S. companies experiencing actual or attempted check fraud, how confident are you in your check printing software and systems? Checks are still the most utilized form of business-to-business payments. While checks had been on the decline since the mid-90s, they are starting to level off², meaning checks are not dead and fraud is still very real. So, ask yourself;

• When was the last time your check printing software was updated?

• Does it have layered security?

• Auditing features?

• Is it easy and efficient for your front line tellers or employees to use?

• Are your employees doing double manual entry in separate systems?

• Is your IT team putting band-aids over band-aids to make your current systems work in sync?

As a leader in the document security industry, we see the need for tighter security and new features which thwart fraud and counterfeiting. So, we worked with our developers and created AssurePay, a feature-laden software designed for front line tellers at banks and credit unions, and a version for corporate entities, too.

Security Features You Can Count On

Did you know it’s estimated IT teams can spend 60 to 90 percent of their budgets band-aiding older systems³? This leaves very little or no room for new technologies to make you, and your teams, more efficient and more importantly, more secure. With the ability to run AssurePay in automation mode on a server, or with manual user interaction on a local PC, your IT team can fully control who sees what so you can be secure knowing your customers’ data is safe, and so is your brand reputation.

Plus, since AssurePay integrates with most existing ERP accounting systems, there wouldn’t be a need for any changes.

Both versions of AssurePay come equipped with 1) positive pay, 2) reporting for easy account reconciliation, 3) integration into most ERPs to help reduce clerical errors, and 4) auditing to help safeguard against internal fraud. As well, TROY offers printer tray locks to deter theft of preprinted or blank check stock, and our security toner and micro print make check washing and photocopying a counterfeiter’s worst nightmare.

As well, the biometric fingerprint capability eliminates swipe cards which could be a security hassle if the card is lost or stolen. With the biometric scanner, only authorized users can release signatures.

What Sets AssurePay Above Competitors?

Besides having more security features than any other solution, AssurePay is highly configurable. The software allows for expansion into other applications, other departments and you can set different business rules for each dedicated department. This allows for flexibility, scalability, and ease of integration on your IT department.

Our Technical Support team is top-notch, located in the US, and highly knowledgeable. It’s important to know you’re getting a support team who can actually help; not just an online knowledge base or chat function. We are real, helpful, and dedicated to providing secure solutions.

To learn more about TROY AssurePay, contact a representative by phone at 304-232-0899, e-mail securesolutions@troygroup.com, and visit www.troygroup.com.

Related Posts

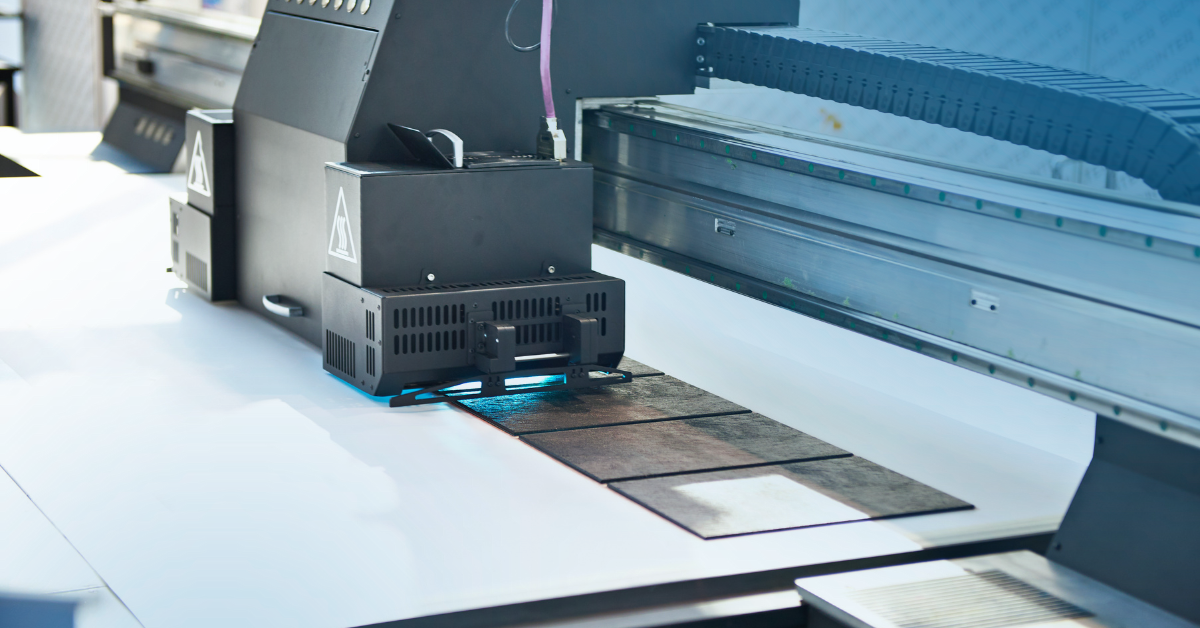

What is UV Printing? UV Curable Inks for Packaging

Ultraviolet, or UV printing is an advanced digital technology that cures specially designed inks using UV light. This process creates sleek, vibrant designs that dry instantly,..

Here's How to Beat Upcoming Postage Rate Increases

In 2024, a notable increase in postage costs became a reality. With postage increases expected to occur multiple times a year, it's important to be prepared for what's coming.

What is MICR Toner? A Guide for Check Printing

What is MICR? MICR stands for Magentic Ink Character Recognition, and it plays a critical role in check printing. If you're printing checks for your business, you should always be..

Leave a Reply