Educating for Security: MICR Printing in the Education Industry

In the vast expanse of the ocean, lurking beneath the shimmering surface, powerful creatures command awe and respect. Sharks, with their sharp teeth and primal instincts, symbolize both danger and strength. As the education industry dives into an increasingly digitized world, it too faces hidden dangers that can jeopardize its transactions.

The education industry’s transactions include payrolls, fulfilling invoices, paying out grants, and purchasing items from suppliers. Although many of these transactions have been digitized, others such as fulfilling invoices to third-party suppliers are done using checks. Making these payments is where hidden dangers lie and sharks swim around with the intent to seek vulnerabilities and strike.

One of the most vital elements of safeguarding check transactions is the implementation of Magnetic Ink Character Recognition (MICR) printing. Just as we strive to understand the behavior of sharks to ensure our safety while navigating water bodies, we must explore the significance of MICR printing in protecting the education industry's financial ecosystem.

The Evolution of MICR Printing: A Vital Security Measure

To comprehend the value of MICR printing, it is essential to trace its evolution from a rudimentary concept to a cornerstone of secure transactions in the education industry. This section will explore the history of MICR printing and how it has become indispensable in ensuring the integrity and authenticity of financial documents.

The origins of MICR ink can be linked to the emergence of the first computers during the latter part of the 1940s. These initial machines relied on input from punched cards, storing data in binary code. With the advancement of computing technology, there arose a necessity for banks to enhance the efficiency of check processing. This process used to be arduous and time-intensive, demanding bank personnel to manually key in information from every check into the computer system.

In response to the imperative for a more streamlined check processing mechanism, the American Bankers Association (ABA) initiated the establishment of a committee in 1952. The purpose of this committee was to investigate novel technologies capable of automating this procedure. Their primary objective involved the formulation of a standardized machine-readable code that could be imprinted onto checks and other financial papers. The end goal was to eradicate the requirement for manual data input.

The committee's ingenious solution centered around employing magnetic ink to inscribe a distinct code onto the lower section of checks. This code encompassed comprehensive details concerning the account holder and the transaction itself. Its interpretation was to be executed by specialized machines referred to as MICR readers. These devices would proficiently and accurately decipher the encoded data, subsequently transmitting it to the bank's computer system.

Today, the ABA and most banks require MICR printing for businesses and individuals who intend to print checks.

The Hidden Dangers of Standard Toner: Unveiling the Shark in the Shadows

Much like the unknown depths of the ocean, the pitfalls of using non-MICR ink in the education industry's transactions often remain hidden. These pitfalls include:

- Manual Check Clearing: The use of generic or standard toners for check printing necessitates a manual clearing process for issued checks. During this manual procedure, tellers employ visual scrutiny to detect flaws or employ blue light counterfeit detection tools to examine the document. These methods, while employed to ensure accuracy, are not entirely foolproof and opportunistic individuals exploit these latent dangers to engage in fraudulent activities. It's crucial to acknowledge that not all financial institutions employ optical technology to scrutinize checks. As a result, businesses employing non-MICR toners for document printing inadvertently pose challenges to these institutions. This stems from the fact that checks printed with such toners fail to fulfill the magnetic requisites necessary for compatibility with their scanning tools. Consequently, manual processing methods are enforced, opening concealed vulnerabilities that malicious actors can capitalize on.

- Meeting Regulatory Requirements: The Federal Reserve and banks mandate that businesses and financial establishments exclusively utilize MICR toners for check printing. The rationale behind this directive is that the use of non-MICR toners introduces numerous complications for institutions engaged in payment processing. To mitigate these complexities, financial entities are compelled to either reject these checks outright or impose supplementary charges to offset the added processing efforts they entail.

Ensuring Authenticity: How TROY Patented MICR Technology Safeguards Financial Transactions

While MICR printing acts as a tool for reading and processing checks, shielding the education industry from potential fraud threats is still needed. As stated earlier, MICR toners integrate distinct code lines and authentication features that help distinguish authentic checks from manipulated ones, but through TROY's innovations to MICR, you can secure checks with:

- Tamper-evident ink: TROY MICR Toner Secure is a fraud-resistant toner that produces red dyes when attempts are made to wash checks or change the information within them. Hence, once checks are printed with MICR ink, the possibility of manipulating checks without destroying them is impossible.

- Authentication features: TROY MICR Toner Secure ink is used to print custom security features that ensure checks cannot easily be counterfeited. Hence, even if fraudsters steal unsecured check stock, using it to create an authentic check will be difficult.

Riding the Waves of Secure Transactions

Just as sharks play a crucial role in maintaining the balance of our oceans, TROY MICR Toner Secure printing acts as a guardian, ensuring the security and authenticity of education industry transactions. By understanding the hidden dangers of non-MICR ink, exploring the benefits of MICR printing, and embracing its future-proofing capabilities, the education industry can confidently navigate the digital waters while protecting its financial ecosystem. Just as we develop strategies to coexist with sharks without jeopardizing our safety, implementing MICR printing is essential for safeguarding the education industry's transactions. It is through education, awareness, and the utilization of cutting-edge technologies like MICR printing that the education industry can revel in safe and secure waters. To learn more about using MICR printing to secure your check and document printing processes, speak to a TROY Group professional today.

Related Posts

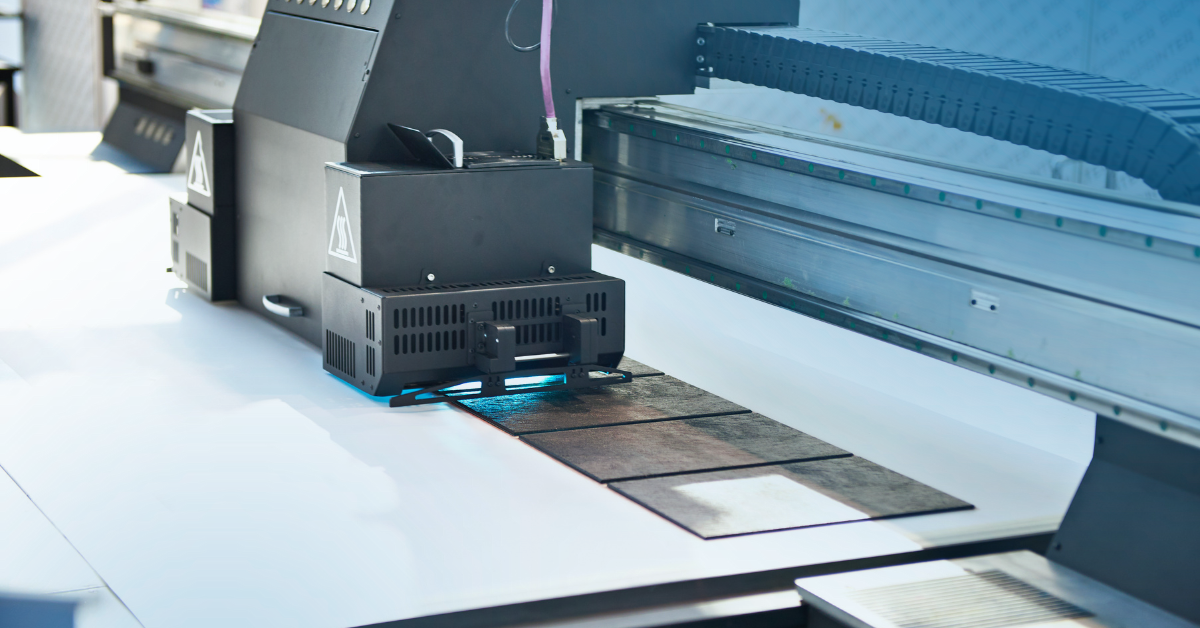

What is UV Printing? UV Curable Inks for Packaging

Ultraviolet, or UV printing is an advanced digital technology that cures specially designed inks using UV light. This process creates sleek, vibrant designs that dry instantly,..

Here's How to Beat Upcoming Postage Rate Increases

In 2024, a notable increase in postage costs became a reality. With postage increases expected to occur multiple times a year, it's important to be prepared for what's coming.

What is MICR Toner? A Guide for Check Printing

What is MICR? MICR stands for Magentic Ink Character Recognition, and it plays a critical role in check printing. If you're printing checks for your business, you should always be..

Leave a Reply