A Prescription for Fraud: Check Stock in Healthcare Transactions

In the vast ocean of healthcare transactions, hidden dangers lurk beneath the surface, just like sharks in the water. It is crucial for healthcare organizations to be aware of these dangers and take proactive measures to protect themselves and their patients. One such danger that often goes unnoticed is the use of unsecured check stock in healthcare transactions. This hidden threat alongside other fraud-related activities costs the healthcare industry approximately $300 billion annually or 10% of the US annual healthcare budget.

In this blog post, we will delve into the alarming consequences of this vulnerability, drawing parallels between these hidden dangers and the predatory nature of sharks. The post will explore both the financial consequences and its effects on healthcare brands. Join us as we explore the compelling need for secure check stock and how TROY Group's comprehensive solutions can help healthcare organizations swim safely through shark-infested waters.

The Underestimated Perils of Unsecured Check Stock

The healthcare industry is notorious for its vulnerability to fraud and data breaches, and unsecured check stock only exacerbates these risks. Just as sharks silently maneuver through the water, fraudsters exploit unsecured check stock to navigate undetected through healthcare transactions. This section will highlight the reasons why unsecured check stock is a breeding ground for fraud, including ease of alteration, counterfeit duplication, and the potential loss of sensitive patient information.

- Unsecured Checks and Counterfeiting: The Federal Bureau of Intelligence outline double billings and phantom billings as some of the methods fraudsters employ to steal from the healthcare industry. Healthcare organizations utilizing unsecured checks are susceptible to counterfeiting because fraudsters can wash or manipulate unsecured checks for personal use. Unsecured checks do not come with any anti-tamper technologies hence creating counterfeits and cashing them enables fraudsters to exploit this hidden danger.

- Identity Theft: Unsecured check stock also refers to checks with patient information that may easily be stolen or accessed by fraudsters. For example, unsecured check stock in unsecured check printers can be stolen and manipulated to defraud the healthcare system.

The Devastating Impact on Healthcare Organizations

Much like the ferocious bite of a shark, the consequences of using unsecured check stock can be catastrophic for healthcare organizations. This section will explore how fraudsters exploit vulnerabilities in healthcare transactions, causing financial loss, reputation damage, and ultimately compromising patient care. Real-life case studies of healthcare organizations that have fallen victim to fraud will serve as cautionary tales, emphasizing the urgent need for adequate security measures against unsecured check stock.

A real-world example includes The Department of Justice’s crackdown on 36 individuals who had created fraudulent checks and stolen personal information to defraud multiple healthcare providers across the United States. The fraudsters were involved in manipulating financial information to steal approximately $1.2 billion from telemedicine providers and original medical equipment manufacturers. Other examples of internal fraud involving falsified checks include that of a clinical laboratory employee stealing approximately $16 million in kickbacks by writing fraudulent checks. These examples led to financial loss and in the case of the clinical laboratory, reputational loss and closure of the business.

Sharks in the Water: Understanding the Shadowy World of Fraudsters

To fully appreciate the significance of securing check stock in healthcare transactions, it is crucial to understand the motivations and methods of fraudsters. This section will dive into the murky depths of the criminal underworld, shedding light on the various types of fraud prevalent in the healthcare industry. By drawing parallels between the stealthy nature of sharks and the cunning tactics of fraudsters, we aim to underscore the need for healthcare organizations to stay one step ahead.

Healthcare organizations must understand that the dangers it faces in terms of using unsecured check fraud are both internal and external. In the internal scenario, employees may choose to manipulate or write checks using unsecured check stock. For external fraud, fraudsters get their hands on unsecured checks through theft, hacking IT systems, and trapping unsuspecting victims. They then write fraudulent checks using unsecured check stock and successfully receive payments from the hospital, the government, or suppliers.

Swimming Safely with TROY Group: Solutions for a Secure Healthcare Environment

TROY Group has been a leading provider of secure printing solutions for over 50 years, helping organizations combat the risks associated with unsecured check stock. As part of our shark week campaign, we offer a range of comprehensive solutions tailored specifically to the healthcare industry. This section will explore the cutting-edge technologies and services offered by TROY Group, focusing on how these can effectively safeguard healthcare organizations against fraud and enable them to navigate the waters of financial transactions securely.

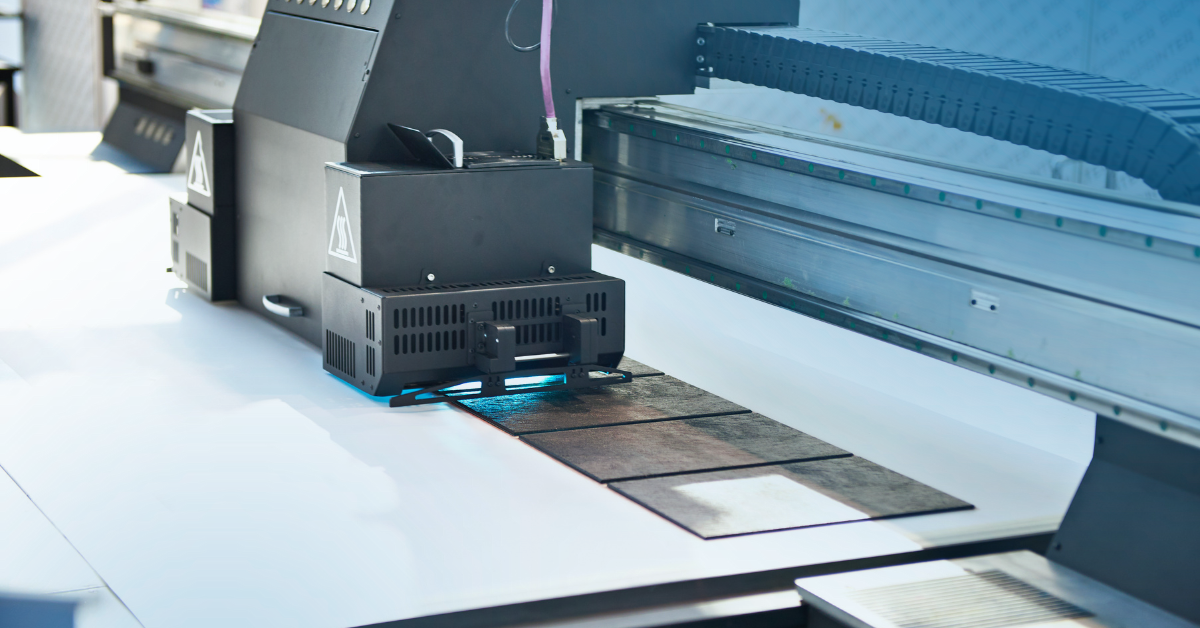

- Safeguarding Against Check Fraud with TROY Group Solutions: Just as the right equipment and knowledge can protect ocean swimmers from sharks, TROY's MICR printing solutions shield insurers from prevalent check fraud schemes. By utilizing our MICR toner with magnetic properties and incorporating security features, TROY Group enhances the security of printed checks, making them nearly impossible to replicate. Hackers or criminals who attempt to manipulate MICR-printed documents release a dye that ruins the entire document or check. Insurers can rest easy knowing they have a robust defense against financial losses resulting from fraudulent activities.

- Ensuring Compliance on the High Seas of Regulations: Navigating the labyrinth of insurance regulations often feels like swimming through a current of complexity. Non-MICR ink exacerbates this challenge by increasing the risk of noncompliance with MICR requirements outlined by authorities. It is important to note that the Federal Reserve Agency and banks require your checks to be printed using MICR toner. TROY's MICR printing solutions guarantee compliance with stringent standards, protecting insurers from penalties and elevating their credibility in the eyes of regulators.

- Benefits Beyond Security: While security is a top concern for insurers, TROY Group's MICR printing solutions offer additional benefits that streamline workflows and improve efficiency. From enhanced accuracy in MICR line placement to faster check processing speeds, the utilization of MICR technology drives operational improvements and cost savings, allowing insurers to cruise through their daily tasks with ease.

Just as awareness of sharks' presence enables swimmers to enjoy the waters safely, understanding the perils of unsecured check stock empowers healthcare organizations to protect themselves against fraudulent activities. The healthcare industry must recognize that securing financial transactions is as critical as curing illnesses and saving lives. By partnering with TROY Group and embracing their secure check stock solutions, healthcare organizations can confidently navigate the treacherous waters of fraud and emerge victorious in their mission to deliver quality care while safeguarding resources. Together, we can reveal and conquer the sharks lurking in the shadows of healthcare transactions.

Related Posts

What is UV Printing? UV Curable Inks for Packaging

Ultraviolet, or UV printing is an advanced digital technology that cures specially designed inks using UV light. This process creates sleek, vibrant designs that dry instantly,..

Here's How to Beat Upcoming Postage Rate Increases

In 2024, a notable increase in postage costs became a reality. With postage increases expected to occur multiple times a year, it's important to be prepared for what's coming.

What is MICR Toner? A Guide for Check Printing

What is MICR? MICR stands for Magentic Ink Character Recognition, and it plays a critical role in check printing. If you're printing checks for your business, you should always be..

Leave a Reply