Prevent Your Checks from Being Rejected: MICR Printing Mishaps

In an age where digital transactions dominate, the humble paper check still holds its ground in various financial transactions. Because check fraud continues to rise, it's important to print your own checks to blank stock to avoid fraud. However, the efficiency of printing checks relies heavily on the Magnetic Ink Character Recognition (MICR) technology—a system that allows machines to read essential information on checks. Despite its importance, improper MICR implementation remains a significant issue.

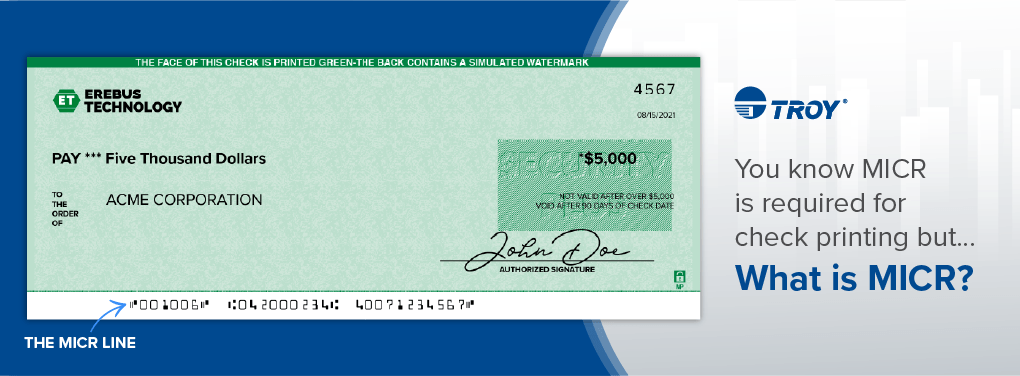

What is MICR?

MICR is a technology used to facilitate the processing of checks. It involves printing characters—such as the routing number, account number, and check number—using a special type of ink that contains iron oxide. These characters are printed in a specific font known as E-13B or CMC-7, which can be easily read by check scanners.

Not only does the MICR font allow scanners to read the check easily, but these fonts, printed with MICR ink or toner are a requirement by the American Banking Association. That begs the question – what happens if you don’t print with MICR fonts with proper MICR ink or toner?

Bank Rejections Due to Poor MICR

Even minor deviations in MICR printing can lead to the rejection of your check during the processing phase, which can add up. Rejected checks due to improper MICR implementation can have significant financial implications for businesses and individuals. Each rejected check represents not only a delay in payment but also the potential for additional fees and penalties.

Banks may charge corporate customers anywhere from $0.50 to $6.00 per item that requires repairing, or for processing poor-quality MICR documents. The time and resources required to rectify rejected checks can further strain financial institutions and businesses.

If you’re printing your account information onto blank check stock, which you should in order to minimize fraud risks, you should be absolutely sure your printing correctly, which is a lot easier said that done. So, what can go wrong?

Common Issues with MICR Implementation

Despite its importance, many factors can contribute to improper MICR implementation, leading to rejected checks. Some of the most common issues include:

Ink or Toner Quality:

The use of low MICR quality in ink or toner or improper printing techniques can result in faint or illegible MICR lines, making it difficult for machines to read the information accurately.

Alignment Errors:

Misalignment of the MICR characters can occur during the printing process, causing the characters to be positioned incorrectly on the MICR line. This can lead to mis-readings or complete failure in recognition by MICR readers.

Font and Size Variations:

Deviations from the standard E-13B or CMC-7 fonts, as well as variations in character size, can hinder the readability of MICR characters, leading to rejection during processing.

How You Can Avoid Printing Issues with TROY:

Luckily, TROY has the most sophisticated MICR lineup in the market, allowing you to print checks accurately and efficiently. TROY’s 30-year partnership with HP allows us to enhance a standard HP printer with security features needed to print checks securely, accurately, and in high quality, ensuring the peace of mind that your payments won’t face rejections from the bank.

Toner Sensing: Toner sensing is a feature that allows the printer to recognize the presence of MICR, so you’re always using MICR toner or ink to print a check.

Exact Positioning Technology: TROY ExPT, or Exact Positioning Technology, allows for precise positioning of the MICR line or check image, so there aren’t any alignment errors.

MICR Fonts: With the addition of our fonts to your current HP printer, you will have the ability to print CMC7 fonts and E13B fonts, and many additional fonts all from one device.

MICR Toner Secure: Our patented MICR Toner Secure has the high adhesion needed for readability, and also contains a red dye that activates any time chemical alteration is attempted on a check. Rest assured your checks are protected from fraud and will always be read accurately by check scanners.

Implement and Test Properly with TROY:

Although TROY’s technology is enough to ensure your checks will be read accurately by the bank, testing should be done to ensure strong MICR signals and readability before you start printing a batch. TROY’s AssurePay Check cloud-based check printing software allows you to send test checks to the bank before you start printing, which we recommend.

The importance of proper MICR implementation cannot be overstated. Investing in high-quality printing equipment, ink, and paper, as well as adhering to industry standards for MICR printing, can help mitigate the risk of check rejection and streamline the payment process for all parties involved.

Learn more about MICR here.

Related Posts

What is UV Printing? UV Curable Inks for Packaging

Ultraviolet, or UV printing is an advanced digital technology that cures specially designed inks using UV light. This process creates sleek, vibrant designs that dry instantly,..

Here's How to Beat Upcoming Postage Rate Increases

In 2024, a notable increase in postage costs became a reality. With postage increases expected to occur multiple times a year, it's important to be prepared for what's coming.

What is MICR Toner? A Guide for Check Printing

What is MICR? MICR stands for Magentic Ink Character Recognition, and it plays a critical role in check printing. If you're printing checks for your business, you should always be..

Leave a Reply