From Fortune to Fraud: MICR Printing in Fortune 500 Companies

In the vast ocean of corporate giants, Fortune 500 companies stand as symbols of prosperity and success. With tremendous wealth and influence in the many industries that rank in such an illustrious group, they are magnets for potential threats, including fraud hungry sharks lurking in the water, seeking to exploit vulnerabilities in their financial systems.

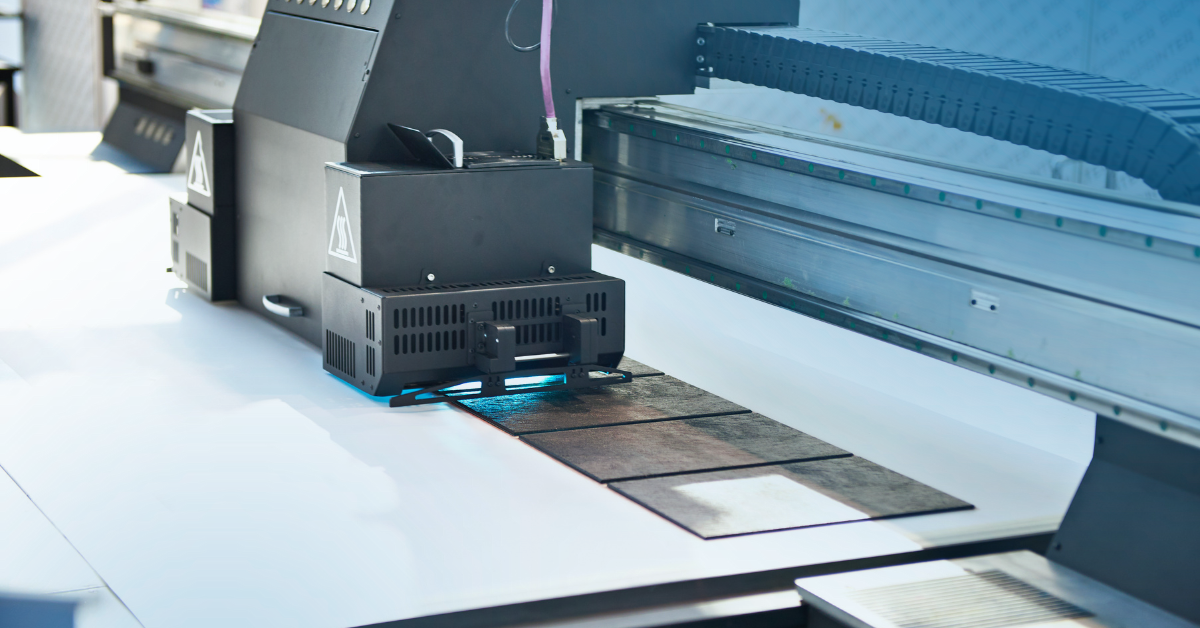

Among the many security measures implemented by these companies, one crucial aspect often overlooked is their use of MICR printing technology. In this blog post, we dive deep into the world of Fortune 500 companies, exploring the importance of MICR printing and how the TROY Group plays a pivotal role in safeguarding these crucial printing operations.

Fortunes Floating in the Deep

Although electronic payments are on the rise, Fortune 500 companies with clients and vendors of all sizes still accept and issue paper checks, even if it is not their preferred method of payment. In fact, 81% of B2B firms and companies still use paper checks for their financial transactions. These checks, which can be issued for hundreds to millions of dollars, are sent through the mail with only a hope that nothing happens to them over the course of its journey. Companies like this have no choice but to let their fortunes float in shark infested waters for a period of time, so shouldn't there be more security measures in place?

While we can trust the US postal service to deliver these large checks timely and accurately, they are still at risk to being intercepted and altered by fraudsters. Even internally, a check being transported to treasury or to an AR department is at risk of being lost or stolen by cunning or disgruntled employee lurking in shallow waters. Any attempt to manipulate or alter printed checks can have disastrous consequences, leading to substantial financial losses and tarnishing the company's reputation.

The Shark-Infested Waters of Fraud

As the saying goes, "Where there's treasure, there will be sharks." Similarly, the vast wealth circulating within Fortune 500 companies attracts skilled fraudsters determined to exploit any weaknesses in their systems. So, what are some of the ways these sharks could attack?

- Counterfeit Checks: Fraudsters often attempt to create counterfeit checks using advanced printing technologies. These checks may look authentic to the naked eye, but they lack the essential MICR encoding, making them detectable during processing.

- Check Tampering: : Another common form of fraud involves altering the data on a legitimate check, such as changing the payee's name or the amount. This can be achieved through various techniques, but innovative TROY solutions makes such alterations noticeable during verification.

- Check Washing: In check washing, the most common form of check fraud, criminals remove ink from legitimate checks using chemicals, altering the payee and the dollar amount. TROY’s patented Secure MICR toners, with its unique security qualities, is the only toner that can prevent this type of tampering.

For Fortune 500 companies that process thousands of checks daily, MICR printing is not only indispensable, but a necessary standard put in place by the American Banking Association. But what exactly is MICR?

MICR (Magnetic Ink Character Recognition) is the technology that enables the processing of checks, a fundamental financial instrument used by businesses worldwide a fundamental financial instrument used by businesses worldwide. By incorporating unique magnetic characters, MICR enables machines to read, and process checks quickly and accurately. However, MICR toner itself cannot protect from fraud.

Amid the threats lurking in the deep waters of the financial world, the TROY Group emerges as a lifeguard for a Fortune 500 companies' MICR needs. For decades, TROY has been at the forefront of developing anti-fraud solutions to protect sensitive information and thwart fraud attempts. TROY MICR inks and toners, along with other innovative products, have a myriad of different security features that include:

- Tamper-Evident Security toners: TROY Group provides ink and toners that come equipped with tamper-evident features, such as chemical reactive MICR Toner Secure, which releases a red dye that alerts the banks when any chemical alterations are attempted, making it nearly impossible for fraudsters to engage in check washing.

- Secure Fonts and Software: TROY Group offers specialized fonts and software that ensure MICR characters are printed correctly and securely onto blank check stock. These unique fonts make it difficult for fraudsters to mimic MICR codes accurately.

Fortune 500 companies are subject to strict regulations and standards when it comes to financial transactions and data security. TROY Group's MICR solutions comply with ABA (American Banking Association) standards.

A Bright Future for Secure MICR Printing

As technology evolves, so do the methods employed by fraudsters. The TROY Group remains committed to staying ahead of the curve, continuously innovating and upgrading its solutions to combat emerging threats effectively.

In the ever-changing landscape of financial security, Fortune 500 companies must remain vigilant in safeguarding their operations from potential fraud. MICR printing, while often overlooked, plays a vital role in maintaining the integrity of financial transactions. Thanks to the TROY Group's innovative solutions and commitment to excellence, these companies can navigate the treacherous waters of the corporate world with confidence, ensuring their fortunes remain safe from the jaws of fraud.

As the relationship between technology and crime continues to evolve, TROY Group's dedication to staying one step ahead serves as a beacon of hope for businesses seeking secure and reliable MICR printing solutions. In the pursuit of safeguarding corporate treasures, the alliance between Fortune 500 companies and the TROY Group stands strong, ensuring that financial security remains a top priority in an ever-changing landscape.

Related Posts

What is UV Printing? UV Curable Inks for Packaging

Ultraviolet, or UV printing is an advanced digital technology that cures specially designed inks using UV light. This process creates sleek, vibrant designs that dry instantly,..

Here's How to Beat Upcoming Postage Rate Increases

In 2024, a notable increase in postage costs became a reality. With postage increases expected to occur multiple times a year, it's important to be prepared for what's coming.

What is MICR Toner? A Guide for Check Printing

What is MICR? MICR stands for Magentic Ink Character Recognition, and it plays a critical role in check printing. If you're printing checks for your business, you should always be..

Leave a Reply