Check Fraud in 2023: What To Expect in the New Year

As financial technology continues to evolve, so do the challenges it brings along. A notable concern that surged in 2023 was check fraud. Despite advancements in digital payment methods, checks remain a crucial part of the financial ecosystem, especially for businesses. As such, they also remain a target for fraudsters. This post aims to provide an in-depth look at the rise in check fraud in 2023, its implications for businesses, and how to fortify defenses against it.

Check Fraud 2023 Statistics: Back in a Big Way

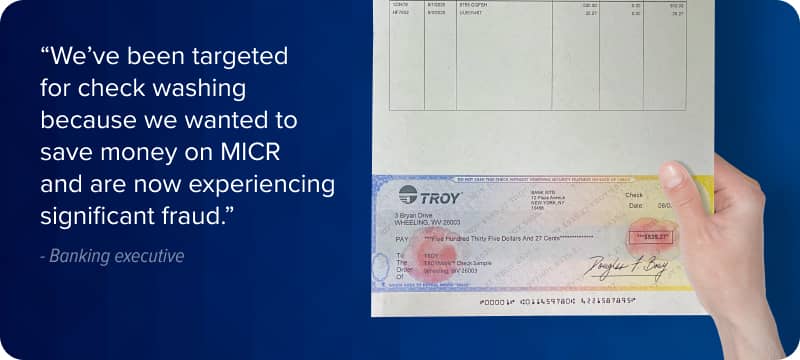

The year 2023 saw a remarkable increase in check fraud incidents, driven by old-school techniques. Fraudsters targeted both large corporations and small businesses by combining both mail theft and check washing, a technique in which fraudsters use household chemicals to wash the necessary accounting information off a check and alter it to go directly into their own pocket.

These schemes may sound outdated, but the numbers aren’t lying. The New York Times recently reported that banks and credit unions are expected to file 540,000 suspicious activity reports, according to analysis from FinCen. This is a 7% increase from 2022, more than doubling 2021. The same report also notes that Regions Financial Corporation was amid a 136 million-dollar check fraud scheme this year in 2023, and it's expected to double in 2024.

In addition, Chief Fraud Strategist for Point Predictive Frank McKenna predicts check fraud to hit $24 Billion in 2023. So, while the use of checks is supposedly in decline, check fraud is steadily rising, and it can have devastating effects to your business or bank if you become a target.

Impact of Check Fraud on Businesses

Beyond the immediate financial losses, which averaged $1.2 million per case in 2023 according to the ACFE, check fraud can inflict significant reputational damage. If your bank is known for being hit with fraud and not responding quickly and directly, you will lose the trust of your customers even if they have accounts open.

Aside from a ruined reputation, check fraud can also disrupt operations as businesses scramble to address security breaches, often requiring substantial time and resources.

Are checks going away in 2024?

Many articles and news sources suggest stopping the use of checks altogether and encourage moving towards digital payment platforms. While that might be manageable to individuals when it comes to certain personal payments, it’s easier said than done for businesses and banks.

Checks still make up a good chunk of B2B transactions, with 40% of businesses still using checks to pay their vendors. 81% of businesses say that even though checks aren’t their number one choice for payment, they still use checks to pay off some firms.

This is largely due to certain businesses simply not being set up to send or receive electronic payments. Moving towards full ACH or EFT payment methods can be complicated, and not every CEO will want to take the time to fully transition their payment process when the original process works, even if it is slower. Virtually every business is set up to receive checks. If not a physical check, a downloadable PDF image of a check - declared the same legal and monetary tender through The Check 21 Act of 2004.

Even though payments are moving towards digital, stopping the use of checks would be chaos. So what is the solution to combating check fraud in the new year without completely changing our processes?

Firstly, you can follow these important steps

- Employee Training and Awareness: Employees should be trained to spot fraudulent checks and understand protocol in such instances.

- Enhanced Authentication Methods: Use of technologies like biometric verification can add an extra layer of security.

- Regular Account Reconciliations: Regular check-ups can help identify inconsistencies early on.

- Fraud Detection Software: Programs designed to detect fraudulent activity can be extremely valuable.

TROY can prevent check fraud in 2024

Luckily, TROY provides everything you need to protect your business from check fraud in 2024. TROY Group's suite of security solutions offers comprehensive protection against fraud with software solutions, hardware products, as well as education and awareness.

TROY’s Software Products include:

Secure Accounting Software: For medium to large-sized businesses, TROY's software solution AssurePay Check is a cloud-based check printing software for medium to large-sized businesses that lets users print checks from a multitude of devices while scaling up check printing production and reducing chain of custody protocols and fraud risks.

Blank Check Stock: Using blank check stock instead of preprinted check stock for your check printing needs will greatly decrease your risk for fraud. Preprinted check stock comes with sensitive account and routing number information printed on the MICR line of the check. When a fraudster gets ahold of a preprinted check, they could write any amount they want and make the check out to themselves. Blank check stock puts you in control, letting you print the MICR lines yourself while safeguarding your account from being frauded.

Security toner: MICR technology, or Magnetic Ink Character Recognition plays a huge role in check printing. Not only does MICR toner need to be used when printing checks to be processed automatically by machines, but it’s a requirement by the ABA, ANSI, and CPA. However, MICR toner itself does not prevent check washing, but TROY’s patented MICR Toner Secure does. MICR Toner Secure releases a red dye whenever any chemical alteration is attempted, alerting the bank of fraud.

Protect Against Check Fraud in 2024

The rise in check fraud in 2023 underscores the importance of staying vigilant in 2024 and beyond. It's crucial for businesses to invest in prevention measures, whether it be employee training or technological safeguards like those offered by TROY Group. The threat of check fraud is real and growing, but with proactive measures, businesses can protect themselves and their hard-earned revenue.

Related Posts

What is UV Printing? UV Curable Inks for Packaging

Ultraviolet, or UV printing is an advanced digital technology that cures specially designed inks using UV light. This process creates sleek, vibrant designs that dry instantly,..

Here's How to Beat Upcoming Postage Rate Increases

In 2024, a notable increase in postage costs became a reality. With postage increases expected to occur multiple times a year, it's important to be prepared for what's coming.

What is MICR Toner? A Guide for Check Printing

What is MICR? MICR stands for Magentic Ink Character Recognition, and it plays a critical role in check printing. If you're printing checks for your business, you should always be..

Leave a Reply